- Book flight

- Manage booking

- Check-in Online

Find the best flights

Our lowest fares to Zimbabwe and South Africa.

From USD 130.00*

*Subject to availability. Book early online to secure the lowest fares.

From USD 108.31*

*Subject to availability. Book early online to secure the lowest fares.

From USD 240.00*

*Subject to availability. Book early online to secure the lowest fares.

From USD 112.33*

*Subject to availability. Book early online to secure the lowest fares.

USD 112.33*

*Subject to availability. Book early online to secure the lowest fares.

Fares to suit YOU

The benefits of flying fastjet

Discover Flexigo

FlexiGo offers our customers greater flexibility and peace of mind when booking their fastjet flight.

We offer three options under the “FlexiGo” banner that assist you in facilitating changes at short notice if you arrive early or are unable to make your flight.

GOEarlier

No fees or fare differences

Arrived early at the airport? Catch an earlier flight if seats are available.

Flexibility

GOLATER

PAY A FEE, NO FARE DIFFERENCES

Missed your flight? Change to a later flight if seats are available.

Choice

GOFIRM

PAY A FEE & FARE DIFFERENCES

Missed your flight? Rebook a confirmed seat for a future flight.

VALUE

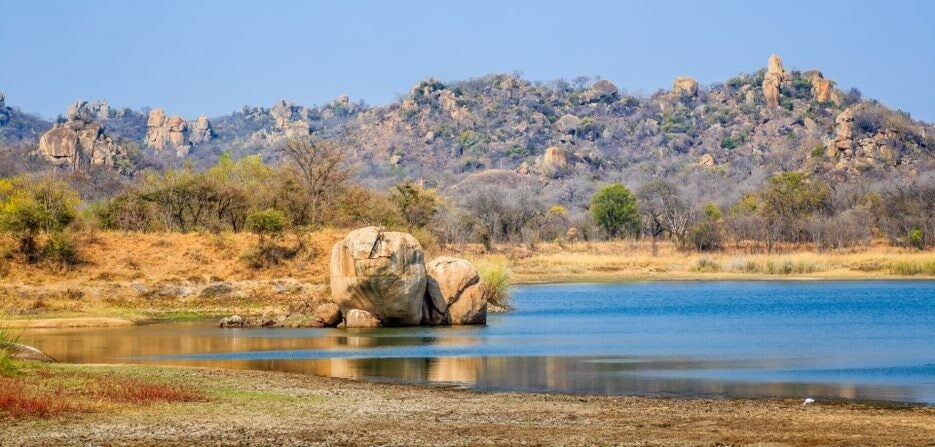

EXPLORE OUR DESTINATIONS

Discover the very best of Africa with flights to select destinations.

Fly from South Africa to Zimbabwe from as low as R 1,895.40*

Travel to South Africa

MORE FROM OUR

NEWS CENTER

See our latest news articles here.

On Google Play

On Google Play

On the App Store

On the App Store

whatsapp Chat

whatsapp Chat

Messenger

Messenger